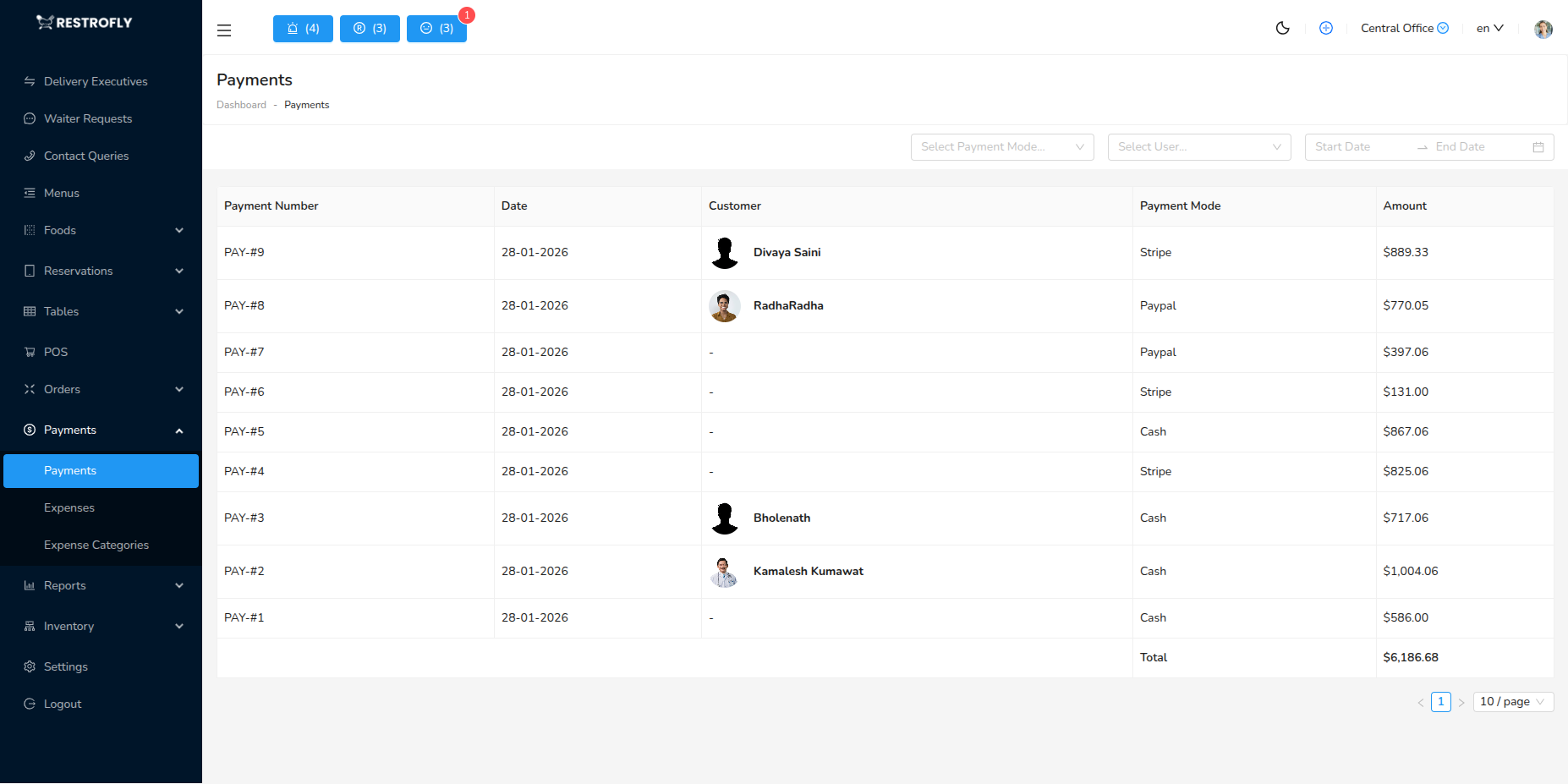

Payments

View and manage all payment transactions. Navigate to Payments → Payments to access payment records.

Overview

The Payments module records all incoming payments from customers - cash, card, online, and other payment methods. Essential for daily reconciliation and financial tracking.

Payment List View

Columns:

- Payment ID: Unique transaction number

- Order Number: Associated order

- Customer: Customer name

- Amount: Payment amount

- Payment Method: Cash, Card, Online, etc.

- Status: Success, Pending, Failed, Refunded

- Date & Time: Payment timestamp

- Processed By: Staff member who processed

Payment Methods:

- Cash: Physical cash payment

- Credit Card: Credit card payment

- Debit Card: Debit card payment

- UPI: Unified Payments Interface

- Digital Wallet: PayTM, PhonePe, Google Pay

- Bank Transfer: Direct bank transfer

- Gift Card: Restaurant gift card redemption

- Other: Other payment methods

Filters:

- Date range

- Payment method

- Status

- Amount range

- Customer

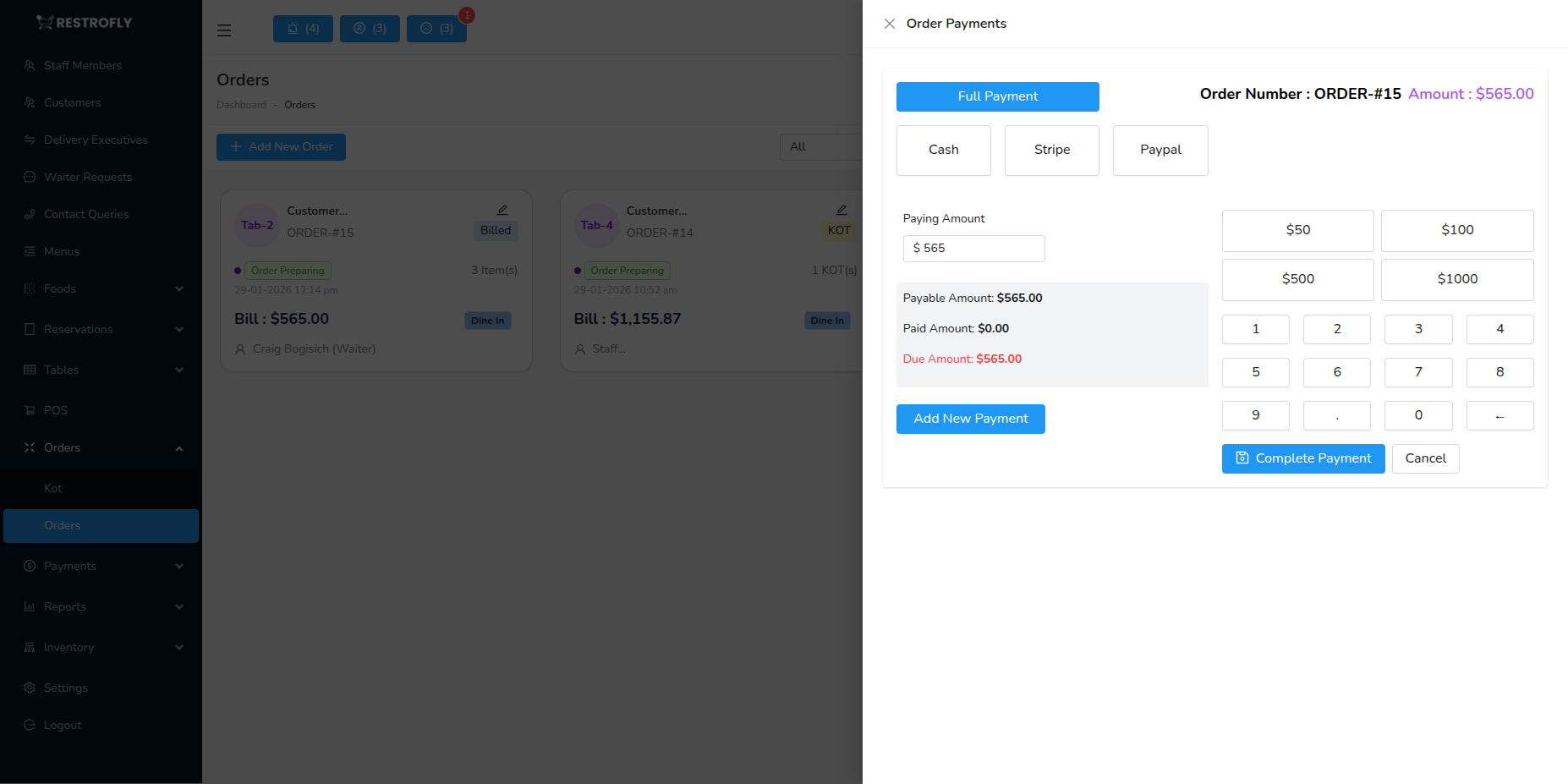

Viewing Payment Details

Transaction Information: Payment ID, transaction reference, payment gateway ID (online payments), authorization code

Order Link: Link to associated order, view order details, match payment to service

Customer Information: Customer name and contact, customer payment history, outstanding balances

Split Payments: If bill split, shows all payment portions, each method used, total reconciliation

Refunds: If refunded, shows refund amount, refund reason, refund date and method

Payment Reconciliation

Daily Reconciliation:

- Run end-of-day report

- Count physical cash

- Match to cash payments in system

- Verify card payment terminal batch

- Check online payment gateway

- Reconcile discrepancies

- Prepare deposit

Reports:

- Cash payments total

- Card payments breakdown

- Online payments list

- Expected vs actual cash

- Outstanding payments

- Refunds processed

Best Practices

Immediate Entry: Record payments immediately, don't delay entry, ensures accurate tracking

Verify Amounts: Match payment amount to order total, confirm before completing, prevent discrepancies

Receipt Management: Always provide customer receipt, keep merchant copy for cards, file systematically

Secure Handling: Secure cash immediately, verify card authorizations, protect payment data

Daily Reconciliation: Reconcile daily without fail, investigate discrepancies immediately, maintain accurate records

Cash Float

Maintain adequate cash float for change. Running out of change during busy periods creates poor customer experience and slows service.