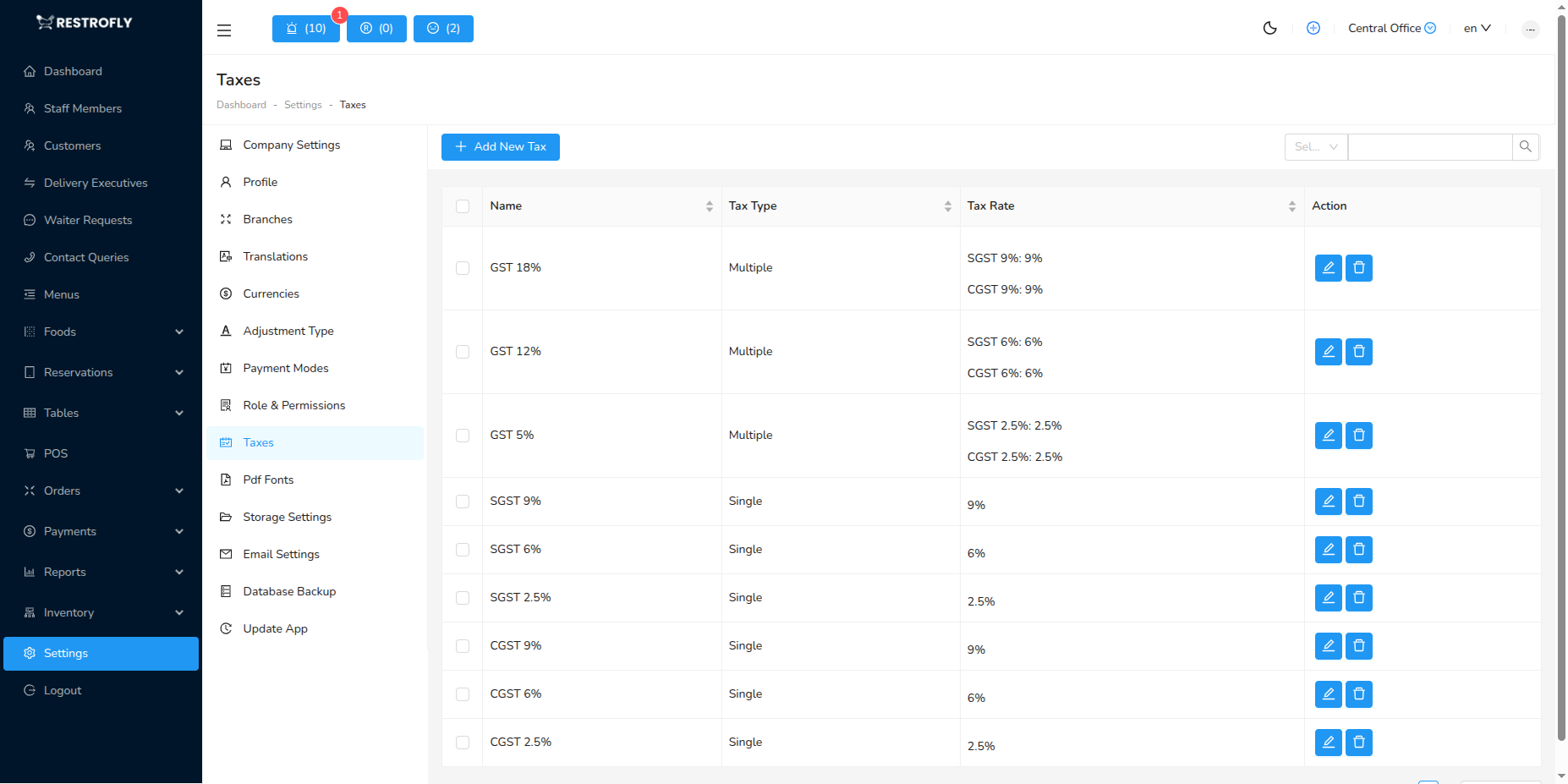

Taxes

Taxes are essential for your restaurant billing and compliance. Restrofly supports both simple single taxes and complex multiple tax combinations, giving you flexibility to handle various tax regulations. You can create and manage different tax rates by navigating to Settings → Taxes.

Understanding Tax Types

Restrofly offers two types of tax configurations:

Single Tax

A single tax is a standalone tax with its own rate. Use this for:

- Standard sales tax

- VAT (Value Added Tax)

- GST (Goods and Services Tax)

- Service charge

- Any individual tax that applies to items

Multiple Tax

A multiple tax is a combination of existing single taxes, automatically calculating the total rate. Use this for:

- Combined GST (e.g., CGST + SGST in India)

- Tax + Service Charge combinations

- Any scenario where multiple taxes apply together

Tax Strategy

Create all your basic taxes as Single taxes first. Then, if you need combinations, create Multiple taxes that reference those single taxes. This gives you maximum flexibility.

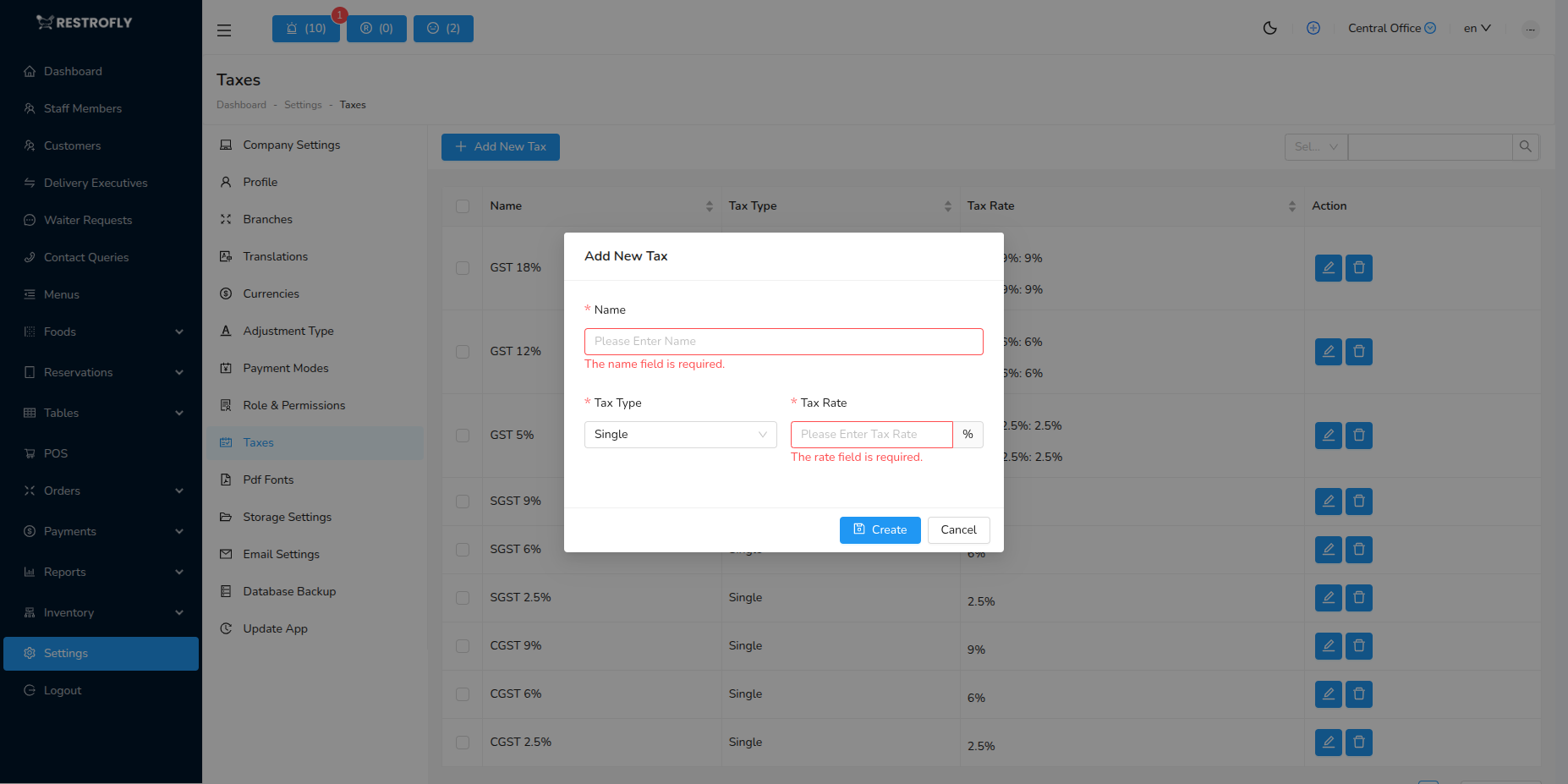

Creating a New Tax

When creating or editing a tax, configure the following fields:

Tax Name

- Name: Enter a clear, descriptive name for the tax (required)

- Examples: Sales Tax, VAT, GST, Service Charge, CGST, SGST

- Appears on customer bills and invoices

- Should be recognizable to customers and staff

Tax Type

- Tax Type: Choose whether this is a single tax or multiple tax combination (required)

- Single: A standalone tax with its own rate

- You manually enter the tax rate percentage

- This tax can be used in multiple tax combinations

- Multiple: A combination of existing single taxes

- You select which single taxes to combine

- Rate is automatically calculated as the sum of selected taxes

- Cannot select other multiple taxes (only single taxes)

- Single: A standalone tax with its own rate

Tax Rate

- Rate: The tax percentage (required)

- For Single taxes: Enter the percentage manually

- Example: 5%, 10%, 18%

- Input as a number (e.g., 5 for 5%)

- For Multiple taxes: Automatically calculated

- Rate = Sum of all selected single tax rates

- Cannot be edited manually

- Updates automatically if you change the selected taxes

- For Single taxes: Enter the percentage manually

Multiple Tax Selection (Only for Multiple Tax Type)

- Select Single Taxes: Choose which single taxes to combine

- Only active single taxes appear in the selection list

- Can select 2 or more single taxes

- The combined rate shows in real-time as you select taxes

- Example: Select "CGST (9%)" + "SGST (9%)" → Total Rate: 18%

Multiple Tax Requirements

To create a Multiple tax, you must first create the Single taxes you want to combine. You cannot create a Multiple tax if no Single taxes exist.

Common Tax Examples

Single Tax Examples

Sales Tax

- Name: Sales Tax

- Tax Type: Single

- Rate: 5%

- Use: Standard sales tax on food items

VAT

- Name: VAT

- Tax Type: Single

- Rate: 10%

- Use: Value Added Tax on goods and services

Service Charge

- Name: Service Charge

- Tax Type: Single

- Rate: 10%

- Use: Service charge on dining

CGST (Central GST - India)

- Name: CGST

- Tax Type: Single

- Rate: 9%

- Use: Central component of GST

SGST (State GST - India)

- Name: SGST

- Tax Type: Single

- Rate: 9%

- Use: State component of GST

Multiple Tax Examples

GST + Service Charge

- Name: GST + Service Charge

- Tax Type: Multiple

- Selected Taxes: GST (18%) + Service Charge (10%)

- Calculated Rate: 28%

- Use: Combined tax and service charge

CGST + SGST (India)

- Name: GST 18%

- Tax Type: Multiple

- Selected Taxes: CGST (9%) + SGST (9%)

- Calculated Rate: 18%

- Use: Combined GST for Indian restaurants

Tax Workflow

Setting Up Taxes

Step 1: Create Single Taxes

- Go to Settings → Taxes

- Click Add New Tax

- Enter Name (e.g., "CGST")

- Select Tax Type: Single

- Enter Rate (e.g., 9)

- Save

Step 2: Create Multiple Taxes (Optional)

- Ensure you have at least 2 single taxes created

- Click Add New Tax

- Enter Name (e.g., "GST 18%")

- Select Tax Type: Multiple

- Select the single taxes to combine (e.g., CGST + SGST)

- Rate auto-calculates (18%)

- Save

Step 3: Apply Taxes to Items

- When creating/editing food items, select which tax applies

- You can choose either Single or Multiple taxes

- The selected tax rate will be applied to the item price

Managing Taxes

Editing Tax Rates

- Single Taxes: You can directly update the rate

- Changes affect all items using this tax

- If this single tax is used in multiple taxes, those will auto-update

- Multiple Taxes: Rate is auto-calculated

- To change the rate, modify the underlying single taxes

- Or change which single taxes are selected

Deleting Taxes

- Cannot delete taxes that are currently assigned to items

- Unassign the tax from all items first

- Then delete the tax

Deleting Single Taxes in Multiple Taxes

If you delete a Single tax that's used in Multiple tax combinations, those Multiple taxes will need to be updated or they may show incorrect rates.

Best Practices

Create Granular Single Taxes

- Create individual components as single taxes

- Example: Instead of one "Total Tax 28%", create "GST 18%" and "Service Charge 10%" separately

- This gives flexibility to apply them individually or combined

Use Meaningful Names

- "GST 18%" is better than "Tax1"

- "CGST 9%" clearly indicates it's the central component

- Include the rate in the name for quick reference

Verify Tax Calculations

- Test your taxes on sample orders before going live

- Ensure multiple tax calculations match your expectations

- Print sample bills to verify tax breakdown displays correctly

Stay Compliant

- Keep tax rates updated according to local regulations

- Document tax changes for audit purposes

- Consult with your accountant for complex tax scenarios

Regional Tax Examples

India (GST)

- Create CGST (9%) and SGST (9%) as single taxes

- Create "GST 18%" as multiple tax combining both

- For inter-state, create IGST (18%) as single tax

European Union (VAT)

- Create VAT at your country's rate (e.g., 20%) as single tax

- Service charge as separate single tax if applicable

United States

- Create state sales tax as single tax (varies by state)

- Create local tax as separate single tax if applicable

- Create multiple tax if both apply

Tax Compliance

Ensure your tax rates comply with local regulations and update them when tax laws change. Consult with a tax professional or accountant for your specific region.

Testing Taxes

After setting up taxes, create a test order with different items and verify the tax calculations are correct before processing real customer orders.